Will Hanimadhoo and Gan Airport Become Ghost Airports? Maldives Must Act Now.

The Hanimadhoo International Airport redevelopment represents one of the most ambitious infrastructure projects in northern Maldives. Millions of dollars were invested in its runway, terminal, and support facilities with the aim of transforming the region into a vibrant tourism and aviation hub. Yet, weeks after its inauguration, no international jet services operate to the airport.

21 November 2025

0

Similarly, Gan International Airport is undergoing major upgrades, including terminal expansion and apron enhancements, designed to accommodate larger aircraft and increase passenger capacity. Despite these investments, the absence of direct international flights threatens to leave both airports underutilized, a situation reminiscent of Mattala Rajapaksa International Airport in Sri Lanka, often referred to as a “ghost airport.”

Strategic Investments at Risk

Hanimadhoo was built to handle narrow-body jets like the Airbus A320 and Boeing 737, with a passenger capacity of 1.3 million per year. Gan’s upgrades aim to create a similar capability in the southern atolls.

Without sufficient international traffic, these airports could operate primarily as domestic facilities, wasting billions in public investment.

Why Airlines Haven’t Flown There

Several factors contribute to the lack of jet service:

High Airport Development Fees (ADF) and Departure Taxes, which increase ticket costs.

Limited tourism infrastructure, although new resorts such as Naagoshi and Samana Ocean Views are under development.

Insufficient airline incentives to operate new routes.

Perceived low passenger demand from northern and southern atolls.

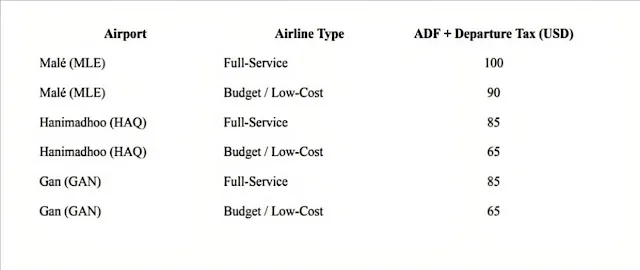

Proposed ADF & Departure Tax Reform - For Reference Only

To make these airports viable, a tiered tax structure should be proposed by the government of the Maldives:

Maldivians flying economy class remain at $24.

Premium and private jet rates remain unchanged: Business $240, First $480, Private Jet $960.

This type of reform will encourages airlines to operate to regional airports while protecting overall fiscal revenue.

Offsetting Revenue Loss

Reducing ADF and departure taxes is estimated to reduce revenue by $10–12 million annually, but targeted domestic measures can offset this (Currently Maldives has many tax benefits in real estate industry):

Residential Rent Tax (5%) – generates $6–7M/year

Social Housing Sublease and Rental Fee – generates $1–2M/year

Real Estate Transfer Tax (1.5–2%) – generates $4–5M/year

Together, these measures cover the revenue gap and strengthen the domestic tax base.

Why This Matters

Attracts direct international flights to HAQ and Gan.

Stimulates tourism and resort development in northern and southern Maldives.

Reduces congestion at Malé and spreads economic benefits regionally.

Ensures fiscal stability without overburdening travelers.

Conclusion

The redevelopments at Hanimadhoo and Gan were meant to create regional economic hubs, not underused airports. By adopting strategic ADF reductions alongside property-based tax measures, the Maldives can ensure these airports fulfill their potential, attracting airlines, tourists, and investment. Otherwise, both airports risk becoming world-class facilities with few flights, a costly outcome the nation cannot afford.

Author

Ali Amaan

Leave a comment

Comments

No comments yet. Be the first to comment!